The digital transformation of financial services has accelerated post-2020, and with it, the expectations for how financial communication is delivered. Investors, media, and stakeholders now expect relevant, timely, and accessible updates across multiple platforms.

The Rise of Multi-Channel Finance Communication

Gone are the days when a press release or earnings call was enough. Today, effective financial communicators leverage:

- Investor relations portals

- Social media (especially LinkedIn and X/Twitter)

- Podcasts and webinars

- Email newsletters and mobile apps

Benefits of a Multi-Channel Strategy

1. Broader Reach

Meet stakeholders where they are, on the platforms they use.

2. Better Engagement

Interactive formats like Q&A webinars or live earnings webcasts improve transparency.

3. Real-Time Updates

Social channels allow quick response to market events or news.

4. Performance Tracking

Digital tools offer analytics to measure reach, sentiment, and impact.

Best Practices

- Ensure consistency of messaging across all platforms

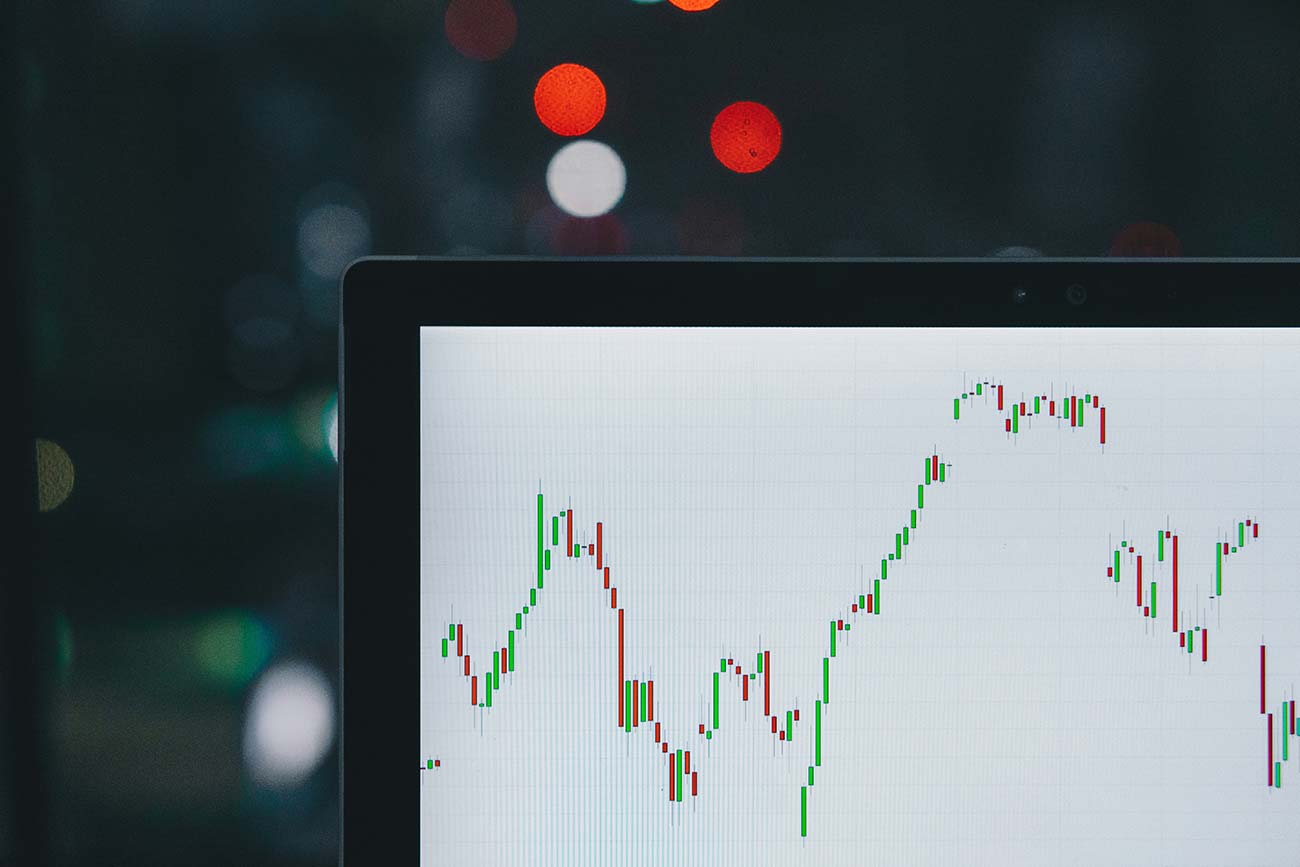

- Use multimedia (charts, videos) to enhance understanding

- Develop a content calendar tied to reporting cycles