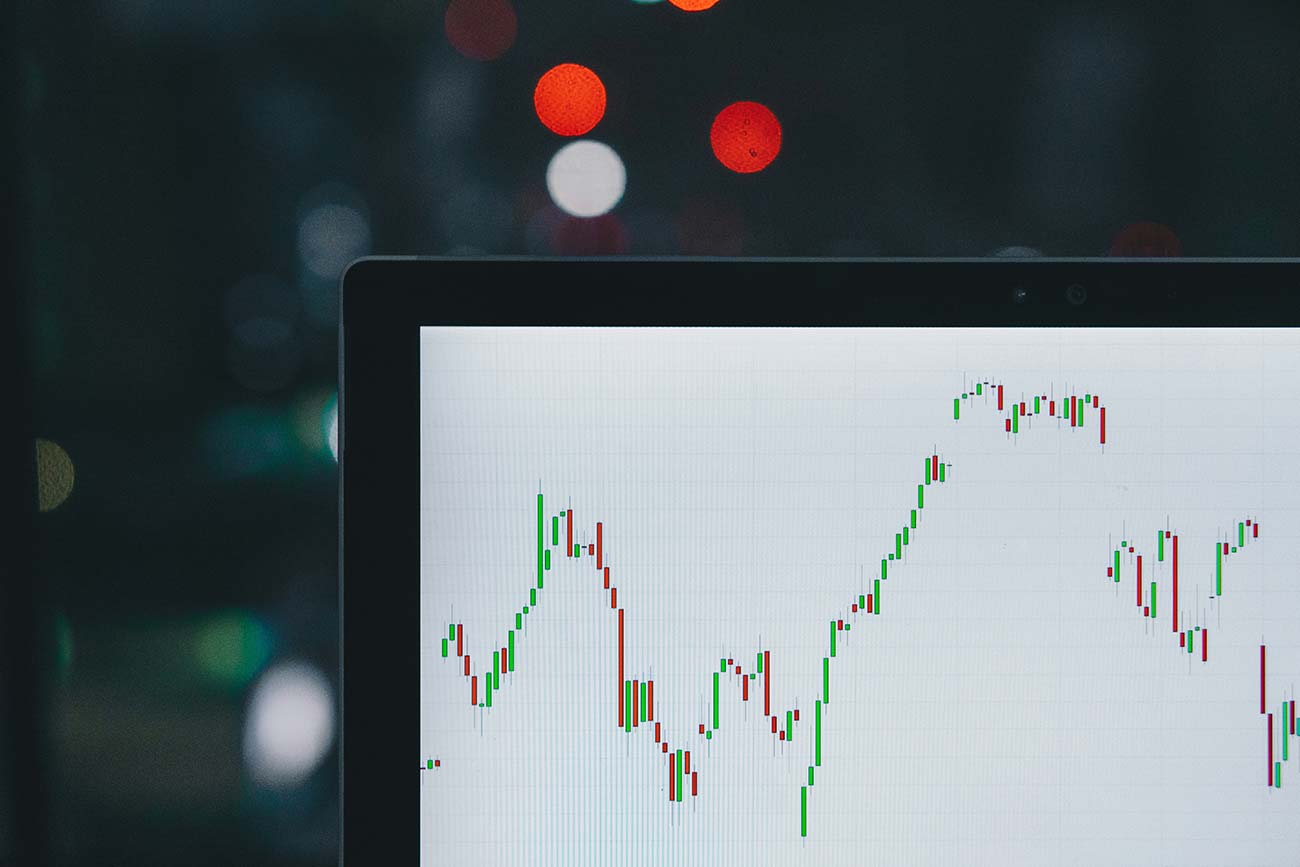

An Initial Public Offering (IPO) is not just a financial event; it’s a communications milestone. As companies transition into the public eye, the ability to clearly articulate value, strategy, and governance becomes critical. Effective financial communication can significantly influence IPO outcomes, from pricing to investor confidence.

Pre-IPO Communication Priorities

1. Building the Narrative

Establish a compelling story that explains the company’s purpose, growth trajectory, and future plans. This narrative should align with investor expectations and market opportunities.

2. Stakeholder Mapping

Identify and segment audiences—institutional investors, analysts, media, regulators—and tailor messaging accordingly.

3. Regulatory Preparation

Collaborate closely with legal teams to ensure all communication is compliant with disclosure rules and listing requirements.

During the IPO Roadshow

The roadshow is the heart of IPO communication. Here, clarity, confidence, and consistency are key. Focus on:

- Presenting key financials in an understandable format

- Anticipating tough questions from analysts

- Reinforcing the strategic vision

Post-IPO Transparency

Once listed, the communication doesn’t stop. Timely and accurate investor relations activities, earnings releases, and ESG updates must continue to maintain market confidence.